IT’S A GREAT TIME TO BUY A HOME!

When choosing a buyer’s agent, you need to build a relationship. The agent is there to represent your best interests. They need to listen. And, that is what we do best. If a different agent shows up everytime you go out looking, you are working with the wrong company. You need a relationship with your broker. When purchasing a property in today’s market, it is not unusual to find more than one buyer trying to out bid you. We will have an objective eye and an ongoing relationship with the seller’s agent. Use that edge. Full service agents like us, bring an additional layer of confidence that the deal will get done.

With the competitive nature of the current real estate market, your 312 Estates agent is educated, aggressive, understands current values, and is also respected by his peers. A reputation for high ethical standards and attention to detail is a must when negotiating for that standout property. Confidence between agents will get the deal done.

Successful listing agents will consider more than just the dollars offered – there are many additional factors that need consideration. One of these is the agent representing the buyer and his/her ability to get to the closing table. And, knowing the client is essential. You don’t need someone to hold your hand between showings, you need someone to have your back throughout the process.

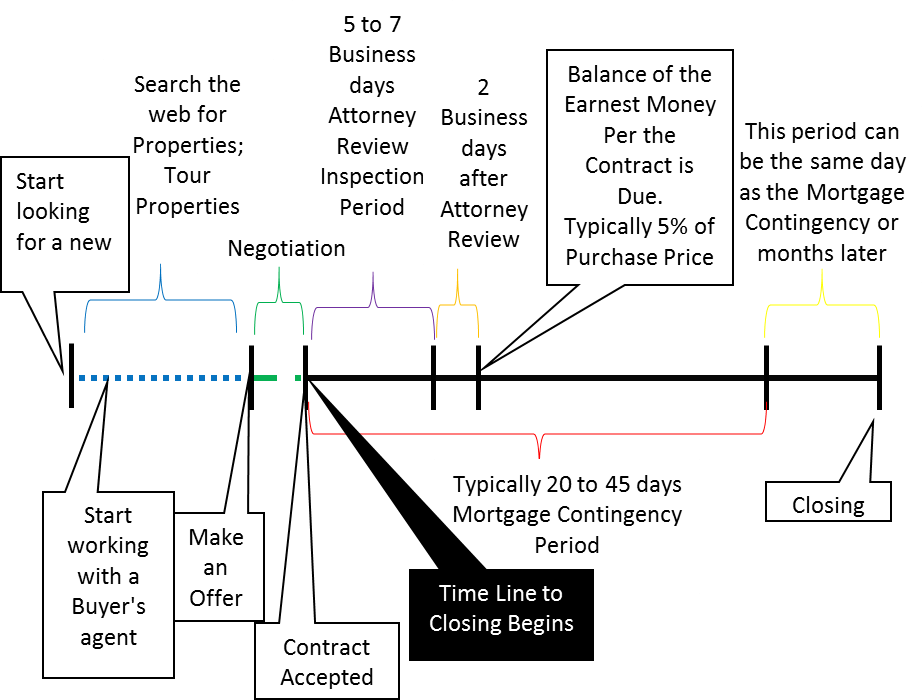

Below is a timeline of the buying process.

buyer-time-line

This handy Buyers Guide will show you some things to keep in mind as you are hunting for that home of your dreams.

FINDING THE RIGHT HOUSE

How much house you can afford is largely dependent on how large a mortgage (basically, a home loan) you can handle.

Start your research by using our simple mortgage calculators in the buyers tab above to see whether you can afford to pay the monthly mortgage on the type of homes you have in mind.

We also encourage you to start an application with a lender before starting to look for a home. This is called getting pre-approved for a loan; it will tell you exactly how much you can afford and may make the closing process go faster.

Remember searching for a home involves more than just a monthly mortgage. You’ll also have to consider monthly payments for taxes, insurance, and potentially monthly assessments. When making an offer you’ll need to have money on hand for earnest money. After closing on a home all home improvements will be on your dime.

Payments you may have to make when you submit an offer and at closing include:

- Earnest money, usually 1% to 5% of the cost of the house, which you pay as a deposit on the house when you submit your offer. It is your proof that you are a serious buyer

- Down payment, usually 10% to 20% of the cost of the house, which you must pay at closing

- Mortgage insurance, paid by borrowers making a down payment of less than 20%

- Closing costs, usually 3% to 4% of the cost of the house, to pay for processing all the paperwork

Don’t forget the day-to-day expenses you may incur once you own that home.

This includes:

- Utilities

- Homeowner or condo association dues

- Property taxes

- City and/or County taxes

Apply to the old rule – You don’t want to be house rich but pocket poor!

Kicking the Tires

House hunting can be both exciting and frustrating. Most home buyers see roughly 15 houses before buying one. To make the search easier and faster, nearly half of all house hunters begin by browsing for properties online, using web sites like this one.

The internet is a quick way to see whether the houses that are currently available meet the following critical criteria: in the right location, with the right features and at the right price. If you find after your internet search that few properties meet with your expectations, you may want to readjust your criteria, change the location, features, price to increase your chances of finding a house that works for you. If you have any difficulties in this initial search, feel free to contact me for assistance. Homes can become available instantly and your agent is always the most current resource for literally up to the minute new home listing information.

After you have defined or atleast narrowed down what you want, where you want to be and what you can afford, it is time to see for yourself. To help stay focused, bring a checklist of the features you have decided are a must have for your future home.

This might include:

- Is there enough room for you to grow your family?

- Is the house structurally sound?

- Is the house in move-in condition or will it need work?

- Is it close enough to everyday needs, such as grocery stores, schools, work?

- Will you feel safe there?

- Do the appliances work to your satisfaction?

- Is the yard right for you?

- Is the floor plan functional?

- Is there enough storage?

- Will you be happy in this house in winter, summer, spring and fall?

- You may also want to take some exterior and interior photos of each home you visit so that you can keep track of its pros and cons.

You can never get it all, so try not to mix and match home features together, unless you plan to build new. Then maybe you can get all you want…but consider Bill Gates 40,000 square foot home, it is alway undergoing some type of renovation. Try not to go there…

While you’re not required to use a real estate professional, it is a good idea.

Ryan Wallenfang and his team at 312 Estates has access to a network of contacts and can draw from extensive market knowledge to help pinpoint the right house for you quickly. These professionals help you structure your deal to save money, explain the advantages and disadvantages of different types of mortgages and guide you through the process and paperwork. We are your full service real estate advocates.